WHAT ARE MANAGED FUTURES

Managed Futures refers to the practice of skilled futures traders, known as CTAs, who manage futures portfolios on behalf of clients with the objective of capitalizing on price movements in commodities, stocks, bonds, and currencies. Investment management professionals have been employing Managed Futures for over three decades, and it has become a crucial component of a well-diversified portfolio for institutional investors such as corporate and public funds, as well as banks, in recent years.

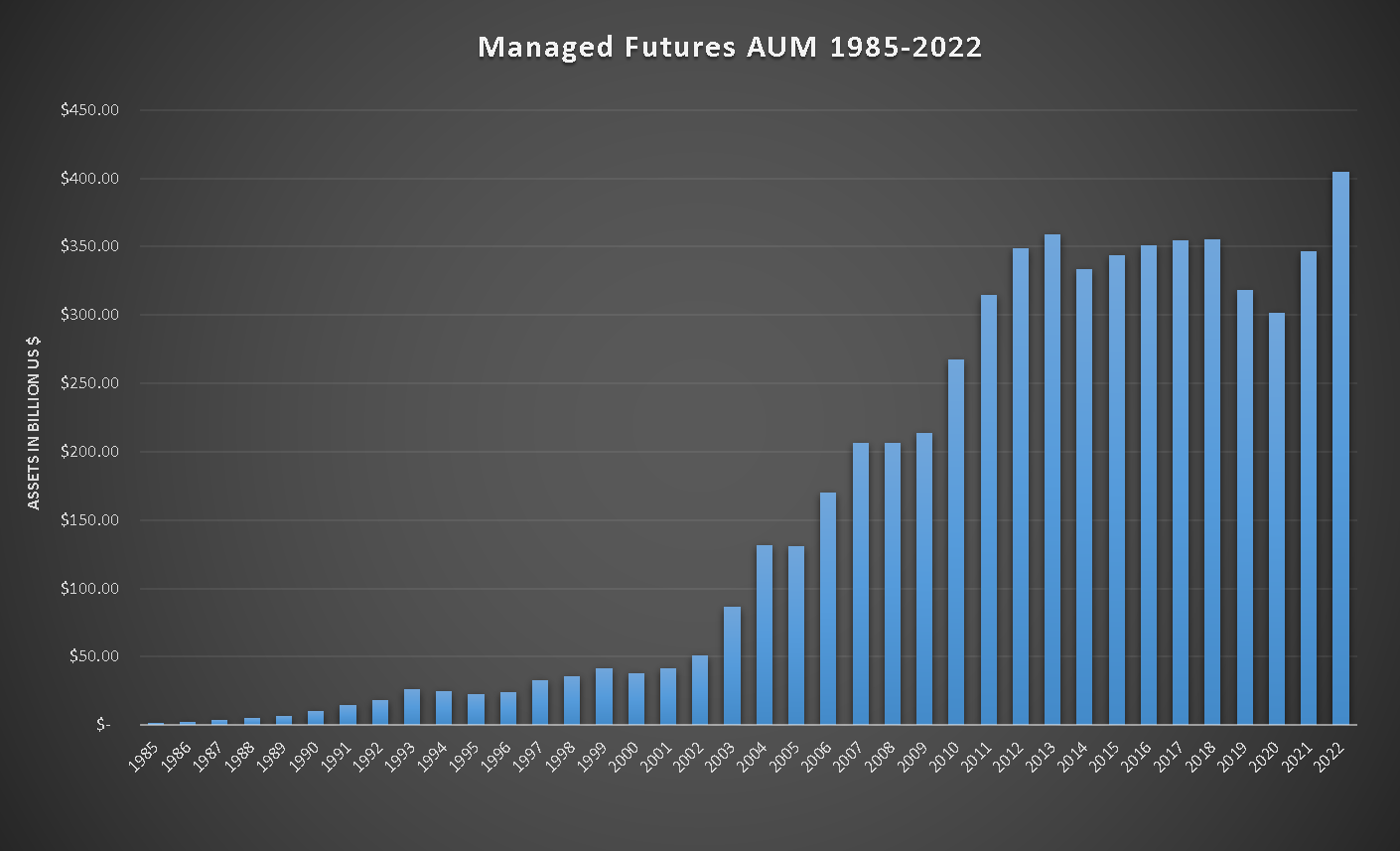

Managed futures is a relatively nascent investment sector with assets under management below $2 billion as of 1985. However, since 1991, the industry has experienced significant growth, spurred by the emergence of new futures exchanges globally and the widespread recognition of managed futures as a valuable component of a diversified investment portfolio.

INVESTMENT VEHICLE

In general, Managed Futures programs can manifest in three distinct forms:

- Commodity Fund

Nowadays, the expression “Managed Futures Fund” is frequently employed since financial futures, not commodities, constitute the predominant trading area in futures. Essentially, a Managed Futures Fund functions as a mutual fund that specializes in futures trading, with investors depositing their funds into the pool that the fund manages. The fund then allocates various CTAs to execute trades with the fund’s assets. - Commodity Pool

Another type of managed futures is the commodity pool, akin to a private futures fund. A Commodity Pool Operator (CPO) establishes the pool by inviting investment from chosen individuals, and the pool functions similarly to a commodity fund.

Private Arrangement

A third variation of managed futures pertains to private arrangements, which are commonplace among sizeable institutional investors. In this scenario, a pension fund, for instance, may choose to allocate a portion of its assets to a managed futures program and subsequently strike an agreement with a CTA to direct all trading activities.