REDUCED PORTFOLIO VOLATILITY RISK

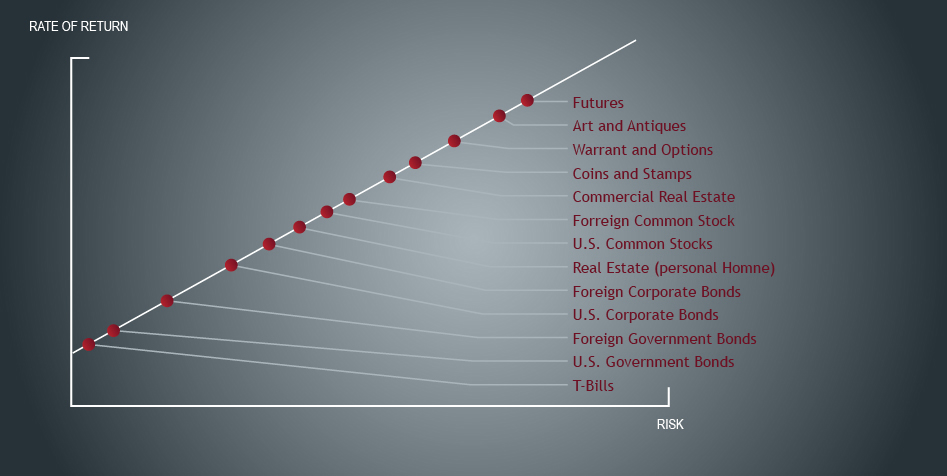

When it comes to investments, volatility is the primary metric for evaluating the relationship between risk and reward. Consequently, the analysis of any investment, especially managed futures, requires a meticulous evaluation of volatility, given their high-risk and high-volatility nature that may result in substantial gains or losses. Typically, augmenting returns also amplifies volatility. The chart below illustrates the risk-reward (volatility) attributes of several asset classes.

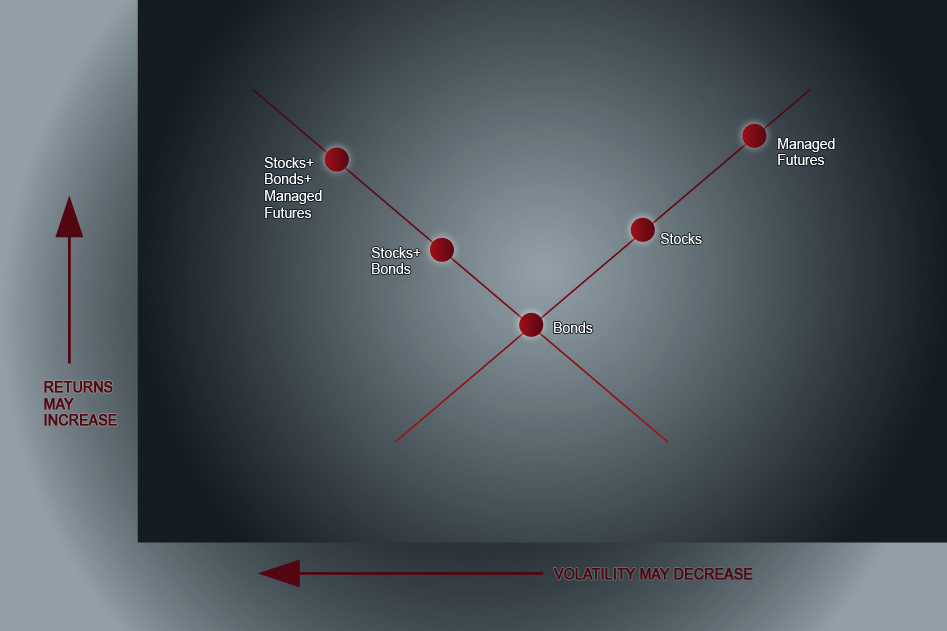

When various asset classes are combined into a single portfolio, how does volatility respond? Typically, a thoughtfully diversified portfolio containing stocks and bonds will display a reduced volatility alongside a higher return. Moreover, when managed futures are incorporated into this portfolio, the risk of volatility is further diminished. (Note that the following chart serves only as an example, and the points displayed are not necessarily proportional to increased returns and decreased volatility).

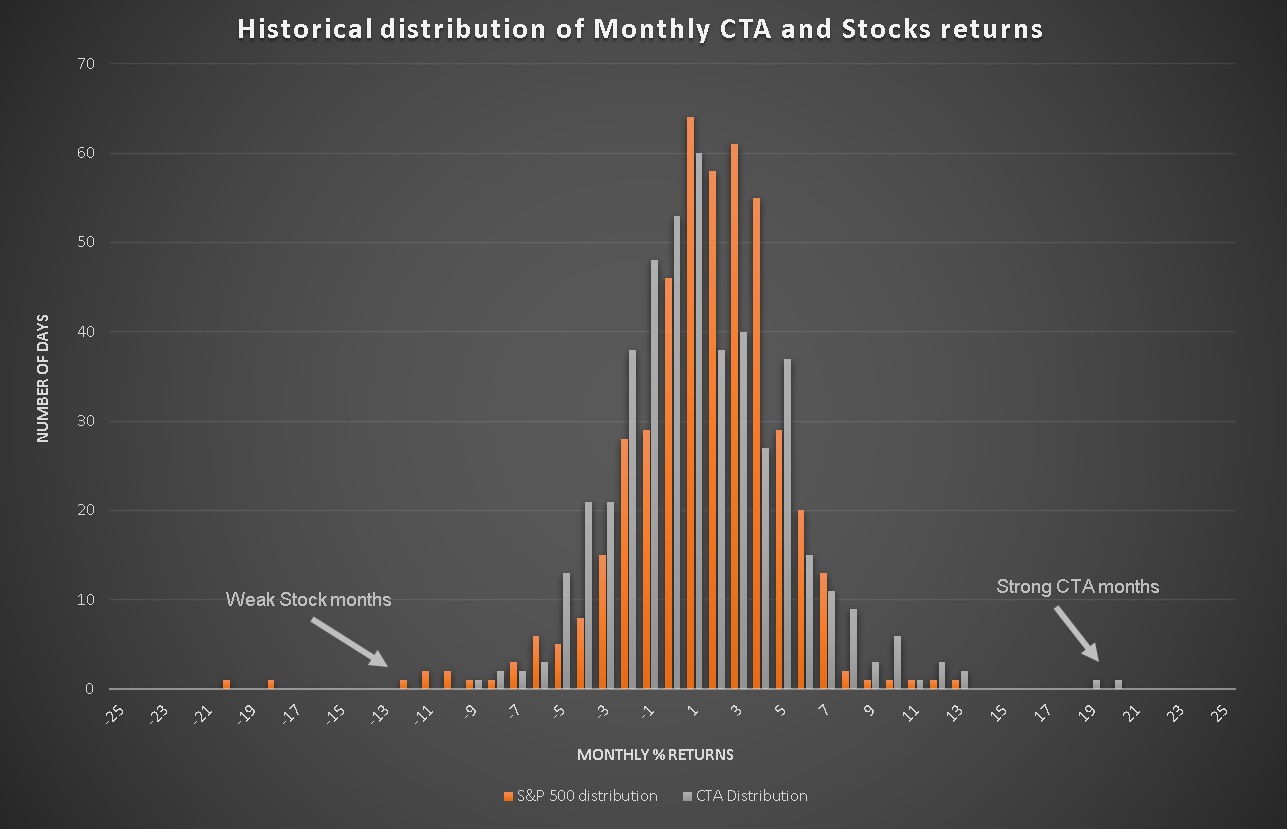

Volatility does not invariably harm investors. Upside volatility is typically desirable, while downside volatility is something we strive to evade.

The diagram below illustrates that managed futures sometimes experience exceptionally robust upward months (outliers) and very few or no severe downward months (such as the October 1987 crash).